[ad_1]

After a week practically dedicated to the Galaxy S22 launch, this week was rather quiet in the mobile landscape. That may be just the calm before the MWC storm, which is coming in a few days. So, for this week’s Winners and Losers, we looked eastward to changes in the Chinese smartphone market and a popular game being banned in India.

But before we move on to the best and worst of the past seven days, check out some of NextPit’s top headlines from the past week below:

Winner of the week: Honor

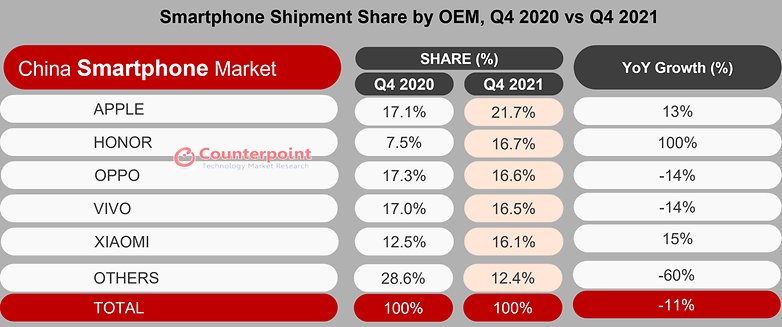

Free from the restrictions imposed on its former owner Huawei, the newly independent Honor overtook its local rivals in the last quarter of 2021, taking the second spot in the huge Chinese market.

Of course, it pales in comparison to Huawei’s numbers in its glory days, but second place in the fourth quarter is noteworthy since Honor’s two main rivals Oppo and Vivo lost around 14% of their market shares, while Honor more than doubled its local participation.

The numbers come from the analysts at Counterpoint Research, who noted that overall smartphone shipments in China fell 11% in comparison to the last quarter of 2020. Apple had a particularly strong quarter, as Q4 is usually the first full trimester of the new iPhones on store shelves.

The report also highlighted Honor’s performance in the mid-to-high-end market, with products such as the Honor 50 occupying the first spot in its segment. Meanwhile, Oppo failed to keep its spot even after including OnePlus in its shipments numbers.

Back to Honor, Counterpoint’s analysts are optimistic about the brands’ future, with the launches of the Honor 60 and Magic V series already showing a further increase in market share.

I admit being really skeptical about Honor’s chances after being spun off, but as the company increasingly breaks its relationship with Huawei, it might be worth keeping an eye on them.

Loser of the week: Free Fire

For the loser of the week, we went for a relatively unknown game in Europe and the US that is incredibly popular in developing countries: Free Fire. The game developed by Garena was banned in India – where it is the number one grossing Android app or game according to Sensor Tower.

The ban is part of another wave of restrictions imposed by the Indian government on Chinese apps. Even though Garena is based in Singapore, Chinese giant Tencent is one of its biggest shareholders.

According to Bloomberg, Garena’s owners’ shares dropped 19% in the New York Stock Exchange right after the news, which threatens not only one of the top-8 highest-grossing games in 2021 – with an estimated $1.1 billion revenue in 2021 according to Sensor Tower – but also Google Play’s Best game of 2021, in the users’ choice category.

It remains to be seen whether the ban will affect the game’s revenues considerably. Even though India is one of the biggest markets for Free Fire, the game already dethroned the smash-hits (and battle royale rivals) PUBG Mobile and Call of Duty: Mobile in the US market in revenue, according to the analysts at Sensor Tower.

Have you tried Free Fire? Do you think it is merely a third-person-view PUBG clone? Where do you see Honor’s global market share for 2022? Drop a comment below with your opinions, and share what your expectations for MWC 2022 are!

[ad_2]