[ad_1]

Last Updated:

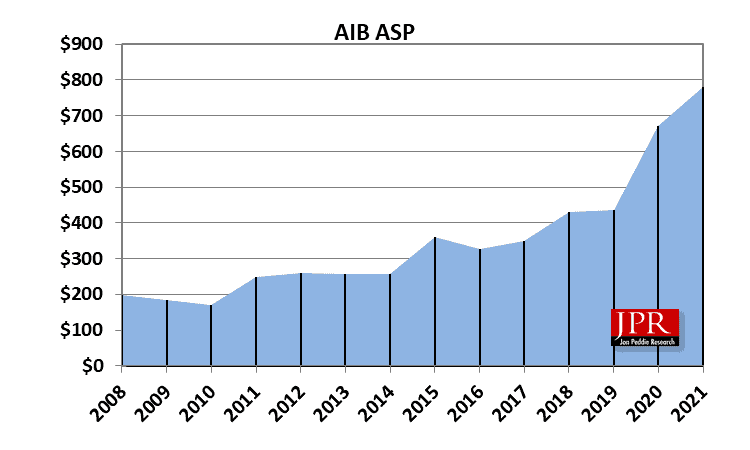

In a study posted up at Graphic Speak, industry researcher Jon Peddie showed off research that suggests that pricing for graphics cards spiked to more than four times their prices just four years ago in a span of five years, but has also stated that the bubble will eventually burst and that the inflated pricing of graphics cards will eventually come ‘crashing down’ as users begin to just say no to the absurdity of the prices and MSRP of cards over the years. We’ve already observed some of the pricing coming down, as AIB manufacturers such as ASUS begin to lower the price of graphics cards in the UK.

If we simply take a look at one of the more consumer-friendly classes of cards, Nvidia’s ’60’ series which targets midrange users, you can see the enormous increase in pricing below.

| GPU | MSRP |

| Nvidia GeForce 560 | $199 |

| Nvidia GeForce 660 | $230 |

| Nvidia Geforce 760 | $249 |

| Nvidia GeForce 960 | $199 |

| Nvidia GeForce 1060 (3GB) | $199 |

| Nvidia GeForce 1060 (6GB) | $249 |

| Nvidia GeForce 1660 | $219 |

| Nvidia GeForce 2060 | $349 |

| Nvidia GeForce 2060 Super | $399 |

| Nvidia GeForce 3060 | $329 |

After around a decade of graphics cards, since the debut of the GTX 560, GPU prices in this class have increased by around 49%. However, Jon Peddie additionally insists that there’s another vector for the increase in pricing that we should pay attention to: the ever-rising popularity of cryptocurrency.

Cryptocurrency’s impact on the GPU market

According to Jon Peddie Research, Cryptocurrencies boom and bust cycles have contributed to the ever-rising costs of consumer graphics cards at AIB manufacturers. It kicked off in 2010 with Bitcoin, surged again with Ethereum in 2017, and now in 2020-2021, we’ve seen further rises in the cryptocurrency market. This enhanced demand for graphics cards, and ultimately ended up impacting the AIB costs of graphics cards, as supply appeared to diminish for consumers looking to get their hands on the latest generation of graphics cards.

Average AIB pricing in 2019 was around $400, then in 2020 it increased by 75%, all the way up to around $700. By the end of 2021, GPU prices were beginning to trend down. Now, in Q2 2022, they have continued to decrease. Now, Jon Peddie suggests that pricing places the blame on miners driving up aftermarket pricing, and also on supply chain issues due to the COVID pandemic. This creates a perfect storm for AIB partners, with data that consumers were more willing to pay extortionate prices for their graphics cards, which resulted in higher pricing.

Now that the cryptocurrency bust has come and gone, we can see that GPU prices are trending lower, with AIBs such as ASUS starting to lower their prices in certain regions. But, there might be an end in sight for the GPU shortage should this correlation hold true.

[ad_2]