Yesterday, Counterpoint released its fourth-quarter report for the US smartphone market. According to the report, premium smartphones were in short supply during the hottest season. This led to flat sales. We guess most of you faced backorders due to supply constraints, delayed launches, and in-store restrictions due to COVID-19. So this is an expected result.

In this regard, Counterpoint Research Director Jeff Fieldhack said, “The US smartphone market was very competitive in Q4 2021. Carriers were aggressive with promotions to retain their smartphone bases. This contributed to continued record or near-record low smartphone churn among the major carriers. Specific to hardware sales, T-Mobile was the largest smartphone channel in the US and grew modestly YoY. Verizon was the second largest smartphone channel and was flat YoY. AT&T was the third largest channel and its smartphone volumes fell just over 4% YoY. The high promotion levels are likely to continue in 2022 and should keep demand for devices elevated, while headwinds are more likely to come from the supply side.”

As for shortages, Senior Analyst Hanish Bhatia said, “Carriers remained under pressure to secure smartphone supply, but regional carriers struggled the most, especially in the case of flagship devices. Overall, inventory remained at record low levels in Q4 2021. Android inventory improved on QoQ basis except for certain flagship devices. Apple inventory remained the leanest but managed to fulfill higher demand. The shortages also helped established OEMs, which have stronger relationships with suppliers, while smaller OEMs faced tough times.”

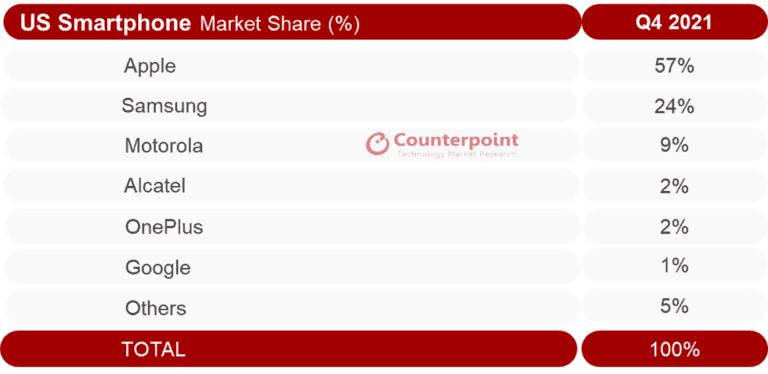

Top Brands In US Smartphone Market

However, we are more interested in the performance of various OEMs. In this sense, Apple sales grew 17% QoQ. But this is not surprising, because we know that the iPhone 13 series is in high demand, especially the Pro models. Currently, both the iPhone 13 Pro and Pro Max have wait times lasting up to six weeks.

The second place in the US smartphone market is occupied by Samsung, which has sales growth of 11% YoY. There have been various factors affecting the company’s better performance. For instance, the Galaxy S21 series devices faced supply chain issues or the case with the Galaxy S21 Fan Edition, which came very late. On the other hand, there have been concrete models and lineups that performed quite well. Say, Samsung’s A series and the foldable handsets helped Samsung to take their piece of the pie in the US smartphone market. Not surprisingly, the Samsung Galaxy A12 became the best-selling Android device in 2021.

In the fourth quarter, Motorola sold the largest number of smartphones in the US smartphone market in its history. In fact, in the past few years, Motorola outruns many competitors. It even launches the first Snapdragon 8 models. And this year, it was no exception.